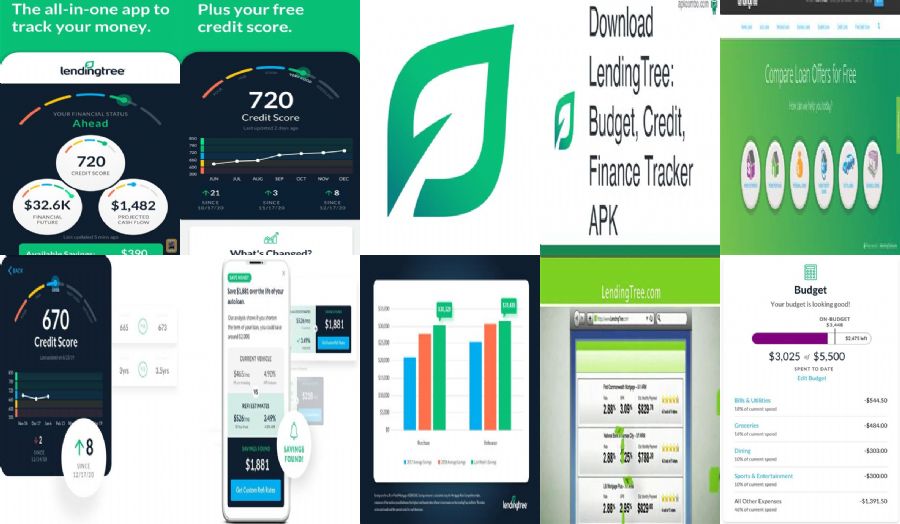

LendingTree Finance Tracker Mod APK Download

Use the LendingTree app to manipulate your private finances, improve your credit rating, and music your payments and costs. We can even help you find savings on current debt – multi functional vicinity! With LendingTree’s cash analysis and price range tracking, we will give you custom designed recommendations on a way to enhance your status nowadays even as helping you work in the direction of a more fit monetary future.

See your credit score every time and what elements are affecting it maximum. With unfastened credit monitoring and credit rating tracking you’ll obtain notifications to whilst it modifications, plus get suggestions on how to improve it.

MANAGE YOUR BUDGET, BILLS AND DEBT

We’ll help categorize and music your finances in one easy vicinity. And we’ll assist evaluate your expenses and spending to assist you to recognize if you’re on the right direction to staying financially healthful. LendingTree will provide you with a warning if it’s time to step in and make modifications.

SET FINANCIAL GOALS

Use our monthly price range tracker to help set goals and hold up to date. Review ordinary charges and live on pinnacle of wherein each dollar is going.

GET PERSONALIZED INSIGHTS AND TIPS

LendingTree can assist screen your credit score, spending, and budget to provide custom suggestions on wherein you could make upgrades. Check your debt-to-profits and assessment how nicely you’re doing.

VIEW YOUR ACCOUNTS IN ONE PLACE

View your bank accounts, balances, investments, or debts in one clean view. We can examine your debts and transactions to provide the personalized insights and suggestions that reveals you ways to improve or save you money. Net really worth tracking, cash glide evaluation, monetary future analysis, we’ve got it all in the LendingTree app.

ACCESS LOANS, CARDS, INSURANCE amp; MORE

LendingTree has been a leader at locating customers financial deals for over 20 years. Whether you wish to borrow cash, refinance, or get a higher fee, discover it thru our app! Tap into LendingTree’s big network of creditors to discover private loans, domestic loans, auto loans, credit score playing cards, coverage and extra. With your statistics synced you’ll already know what forms of costs and merchandise you’re authorized for!

GET HELP WITH YOUR FINANCES

Should more serious help be ever needed, LendingTree allow you to find accurate alternatives for credit score repair, debt comfort, or financial disaster.

We agree with in presenting financial training to our customers.

LendingTree: Finance Tracker Mod download

Get key insights from real LendingTree employees!

PERSONAL LOAN DISCLOSURES

https://www.Lendingtree.Com/legal/advertising-disclosures/?Disclosures=1,one hundred and one

A Personal Loan can offer funds particularly speedy when you qualify you could have your price range inside some days to a week. A mortgage may be fixed for a time period and price or variable with fluctuating amount due and price assessed, make sure to speak with your mortgage officer approximately the real time period and charge you may qualify for based totally for your credit score history and potential to repay the loan.

As of 15-Apr-22, LendingTree Personal Loan consumers were seeing fit prices as little as 2.99% (on a $ten thousand mortgage quantity for a time period of 3 (3) years. Rates and APRs were primarily based on a self-identified credit score score of 700 or higher, 0 down payment, origination fees of $zero to $100 (relying on mortgage quantity and term decided on).

Here’s how it may work:

Example 1: A $10,000 mortgage with a five-yr time period at thirteen% Annual Percentage Rate (APR) would have a most compensation length of 60 months at $228/mo. This loan could have a minimum compensation period of 365 days at $872/mo. The actual fee quantity and 12 months-quit stability will range based totally on the APR, loan amount, and term decided on.

Example 2: A $25,000.00 secured private loan financed for 60 months at an hobby fee of eight.500% would yield an APR* (Annual Percentage Rate) of 8.496% and 59 month-to-month bills of $512.87 and 1 very last payment of $513.24.

These examples are for illustrative purposes most effective.